|

|

||

|

Page 2 |

||

|

Catching the Wave - Electronic Payments as a Competitive Weapon by Ian Drysdale, Vice

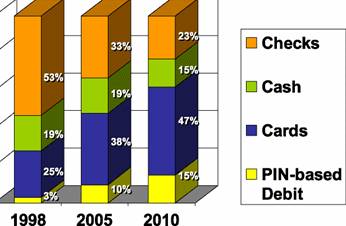

President, First Data Merchant Services It’s no secret that some of the great fortunes in America have been made by identifying and capitalizing on growing consumer trends. The fast food industry has clearly been an area of innovation, satisfying consumers’ need for speed in the 50s and 60s as women began to work in greater and greater numbers. More recently, healthier menus and low carbohydrate offerings are among the innovative concepts that have led to the success of many entrepreneurs. In 1950, the first Diners Club® credit card was issued by Frank McNamara. The card provided status and allowed for sales in an environment where people could not only replace cash, but could spend as much as they would like- more than if they had cash. Electronic payments have since taken off, causing credit and debit card volume to reach into the trillions of dollars globally and gift cards to become one of our favorite national stocking stuffers. Shift to Electronic Payment Types

Is this a wave an operator can benefit from? Without a doubt, an informed operator can add revenue and grow the bottom line. Just as in the food business, when it comes to payments, there are a handful of key “ingredients” that can be presented separately or mixed together as an attractive menu. Each requires its own strategy to maximize benefits and minimize costs. Credit CardsWhy do the major Quick Service Restaurant (QSR) brands all seem to be rolling out card programs? It’s simple-- they have tested acceptance, and the tests indicate greater revenue can be earned when cards are accepted. The theory behind this fact is that consumers are simply not as price conscious when using a card. They are more likely to buy more and higher priced items, and, according to a 2002 First Data survey, are more likely to be loyal and return more often to a QSR that accepts cards. To benefit from this lift, an operator must have well-placed, appropriate signage that indicates the card types that are accepted. Your merchant processor will often provide the signage you need for the asking. Credit cards are all about individual choice. We all carry a different card. There are even cards available now with our own pictures or those of our kids. Consumers generally favor one card, a “top-of-wallet” card, to use card industry lingo, and are often rewarded for using that card. It is important to accept the card that the consumer prefers. Companies have spent billions letting consumers know that the Visa® card is accepted “everywhere you want to be,” and they should not “leave home without” their American Express® card. The Discover® card is “the card that pays you back,” and “for everything else, there is MasterCard®.” The lesson to be learned? To satisfy the most consumers, an operator would want to accept their favorite card, whatever it may be. Most card processors offer solutions capable of accepting all major card types, and some even offer specialized cards such as the JCB® card, which appeals to Asian tourists, and the Diners Club card, which appeals to traveling business people. As with other products, getting the best deal from a credit card processor is often a matter of bringing large purchasing power to the table. If you are a franchise operator, your concept’s corporate office may have already negotiated a good deal - usually better than one your local bank can offer. Be aware that there are special rates, even lower Visa and Mastercard “regular” (retail or restaurant) rates, available for Quick Service Restaurants (QSR). These are called “Small Ticket” rates, and don’t even require a signed receipt for transactions under $15.00, which can speed up your checkout lines. You will want to find a processor that both understands and has proven itself in the QSR market. It’s worthwhile to look around. Debit According to the results of a new study of consumer payment preferences from the American Bankers Association and Dove Consulting, debit card payments made up 31% of in-store payments in 2003 compared to 21% in 1999. In contrast, credit card payments made up 21% of in-store payments in 2003 compared to 22% in 1999. In the fall of 2003, Visa announced that it was processing more debit card transactions than credit card transactions in the US. More and more people prefer debit to cash and even credit cards, as a way to control spending, to have better records than cash, and to even get cash back at the point of sale (POS). Young people drive this trend, according to marketers. Indeed, 25% of this segment’s spending is conducted through debit card products. A typical debit card has a MasterCard or Visa logo on one side and “regional debit network” logos for the STAR®, NYCE®, Interlink®, and/or Pulse® processing systems on the other. If it is used like a credit card, it will be processed through MasterCard or Visa, often at similar rates to a credit card. However, if a consumer enters their PIN (Personal Identification Number) through a “PIN” pad connected to your POS device, costs per transaction are often much lower than a credit transaction, especially when tickets are in the $9.00 - $50.00 and up ranges. PIN transactions also allow for cash back, increasing the value of the transaction for your busy customers who would otherwise have to make another stop during their day to get cash. According to Unisys, customers prefer entering a PIN to signing their name for debit card transactions by a margin of 12%. Gift Card According to Bain & Co., “Since 1997, sales of gift cards have grown 15%-35% annually, with 2003 sales estimated at $42 billion.” Beginning with Blockbuster in the early 90s, consumers, often not wanting to pick a gift that their loved ones may want to return, have picked a gift card as the present of choice. So how does this fit with QSR? Starbucks experiences a whopping 11% of their current sales through gift card transactions. Further, consumers now often treat the StarbucksSM card as a spending card - buying the card for themselves to both speed up transactions and avoid making change. Bain also states that gift cards reduce fraud in comparison with paper gift certificates, as gift cards cannot easily be forged. Fraud is then further reduced, as gift cards are also worthless until a customer purchases them and value is added or the card is activated through a point of sale device. And gift cards have the potential to increase sales. Studies show that 58% of consumers who receive a gift card spend more than the initial value of the card, and purchases made with a gift card are 20-50% higher than the average ticket. Just think of it. Your favorite, most loyal customers can buy cards and give them to people who have not experienced your brand, who then can become loyal customers themselves. Point of SaleA modern POS system is key to speed, and at a QSR, speed is everything. A study by “g3” (formerly known as Sparagowski & Associates) in 2002 indicated that credit, with a properly configured system, is faster than cash. If a swipe is performed by a consumer, rather than an employee, the transaction is about 18 seconds faster than cash. If it is employee swiped, it is about 5 seconds faster than cash. Stand-Beside POS systems such as those made by LinkPoint, VeriFone, and Hypercom offer the advantages of low cost (in comparison with a fully integrated solution), ease of adding a PIN pad, and transaction times as low as ten seconds. Some providers provide fully integrated credit / debit / gift card solutions on a reasonably priced POS terminal. Fully Integrated POS systems such as those offered by Aloha, Compris, and Par Technologies can provide single entry of information, but at a cost. Some of these systems support PIN pads and the leading gift card programs, including those of your brand - and some don’t. It pays to ask your brand’s corporate POS department for their recommendation. In both cases, some of the best providers offer broadband IP solutions. That is, instead of dialing a toll free number, the terminal or Integrated POS system is securely connected, all the time, over a standard cable modem, DSL, or other high-speed Internet line that you can also use for other purposes such as email or web-based training. These systems, often offered at a similar cost to the older dial solutions, can provide for transactions as fast as three seconds- just like at a major retailer. Maximizing the trend towards electronic payments by providing the right menu of customer preferred products - credit, debit, and gift card - can increase sales just as surely as having the right menu on the your board. To enhance your business’ success, you should consider taking advantage of the best POS solutions, accepting all customer-desired card types, and leveraging your brand’s buying power to have a solution in place that both you and your accountant will love. Ian Drysdale is Vice President, Strategic Market Development at FDMS and can be reached at 954.851.7205 or at ian.drysdale@firstdata.com |

||

|

AFA Enews - March 12, 2004 - Volume 2 Number 3 |

||

|

American Franchisee Association |

|

(312) 431-0545 |